Year in Review

Year ended March 2025

Key Figures

- Net Sales

- ¥1,154.0billion

- 4.4%

- Operating Income

- ¥84.7billion

- 0.5%

- Operating Income Ratio

- 7.3%

- 0.3percentage points

- ROE

- 6.8%

- 0.1percentage points

- Capital Expenditures

- ¥56.6billion

- R&D Expenses

- ¥38.8billion

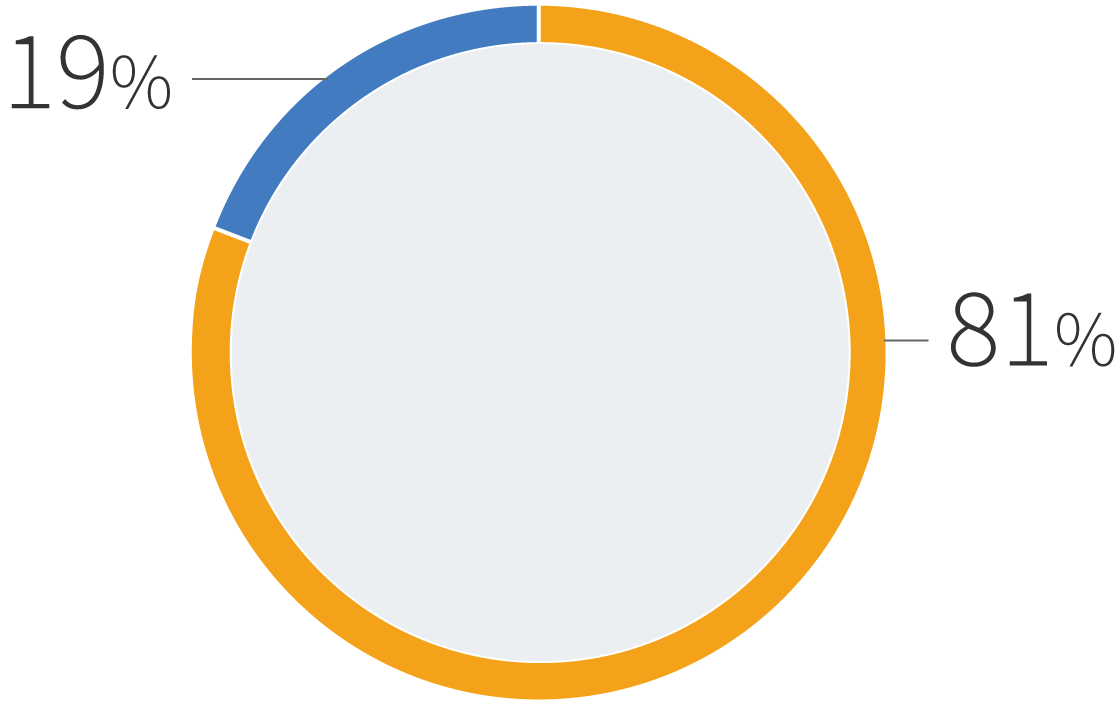

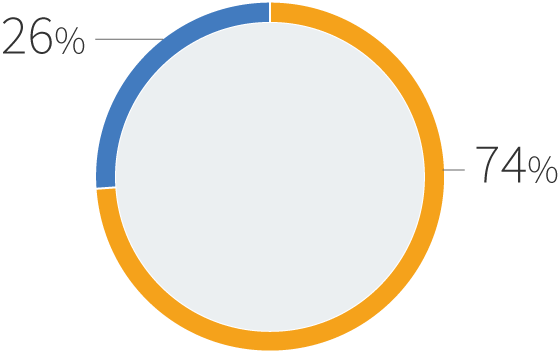

Breakdown by Segment

- Food

- Pharmaceuticals

Net Sales

Operating Income

Business Performance Analysis

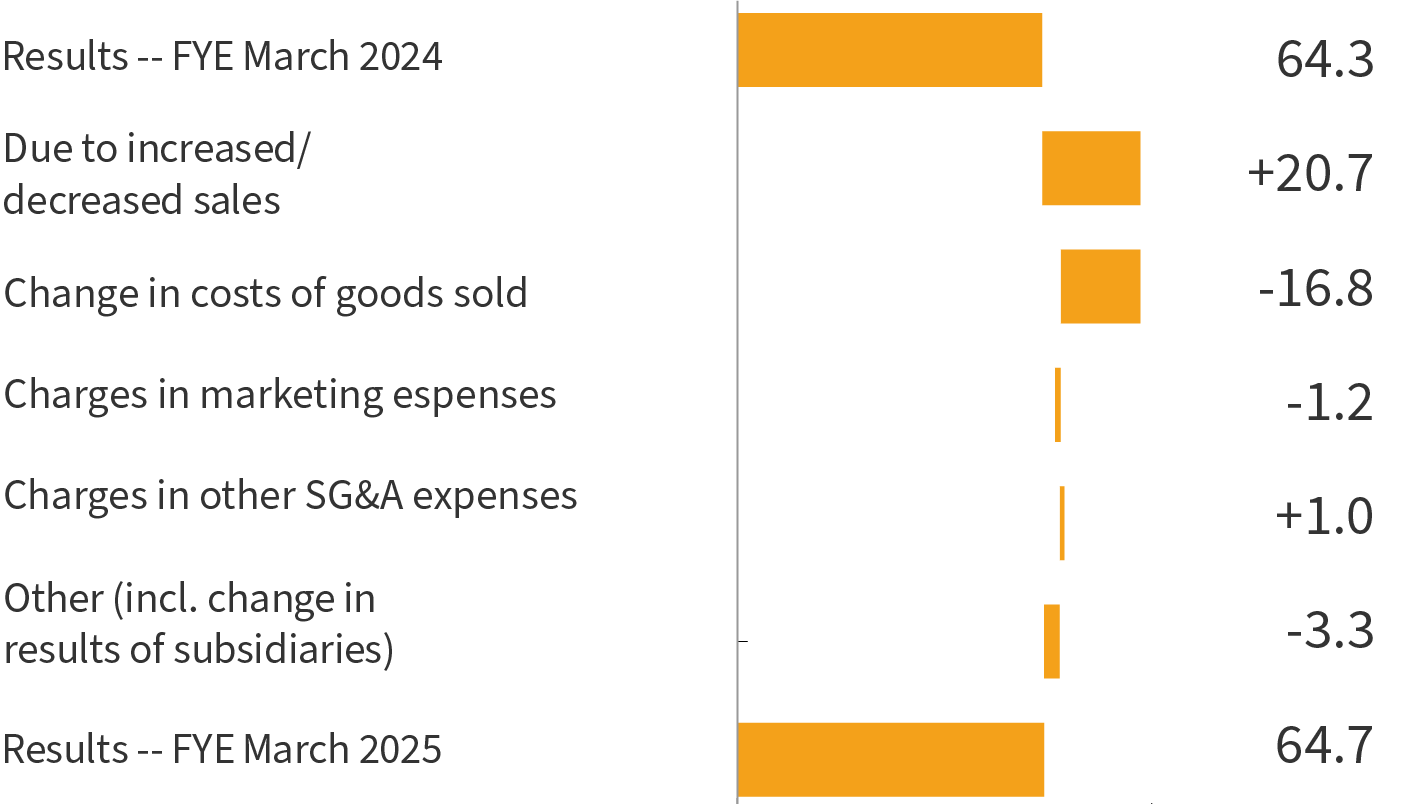

Food

- Net Sales

- ¥925.5billion

- 2.8%

- Operating Income

- ¥64.6billion

- 0.5%

- Income Analysis(Billions of yen)

-

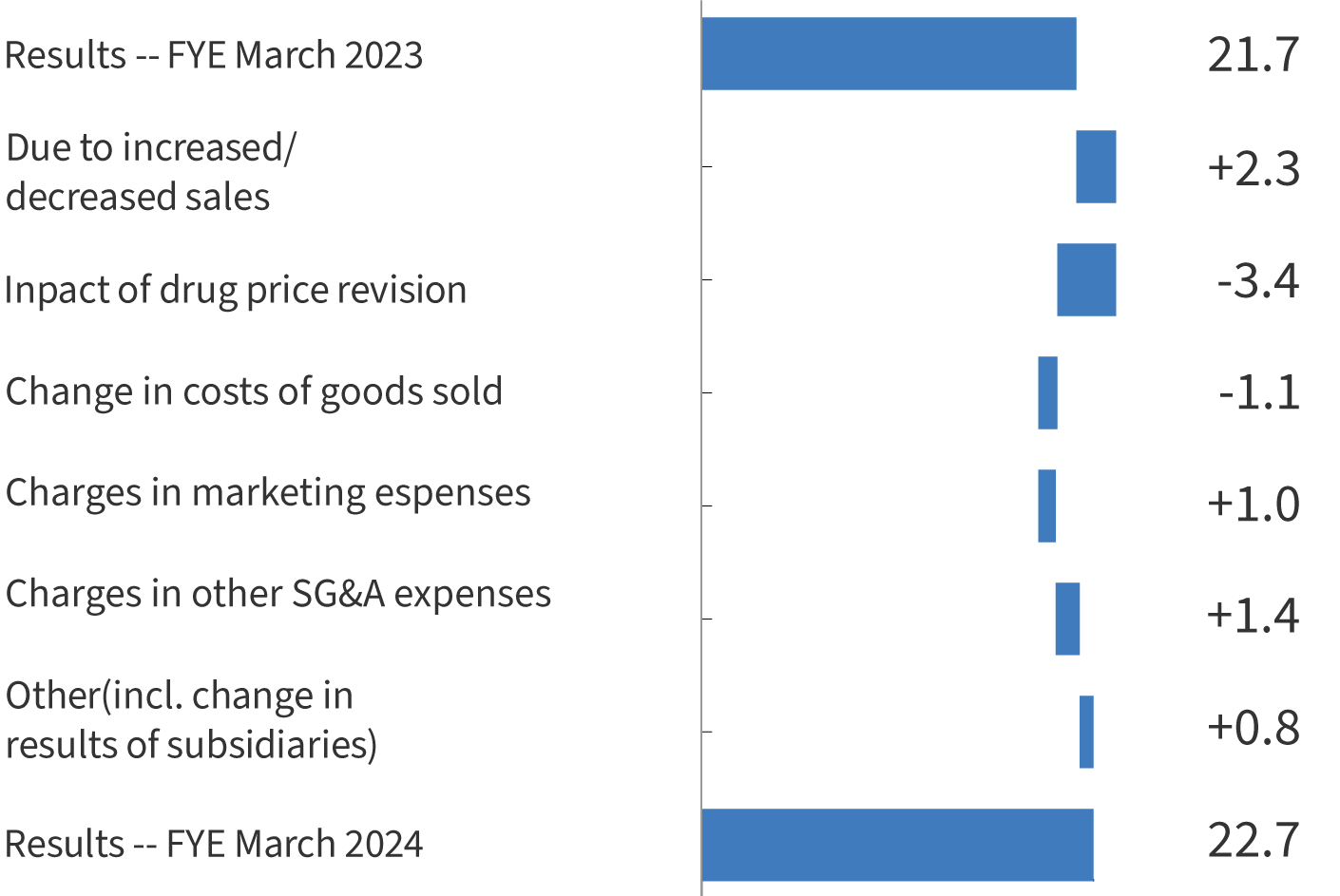

Pharmaceuticals

- Net Sales

- ¥229.6billion

- 11.4%

- Operating Income

- ¥24.7billion

- 8.9%

- Income Analysis(Billions of yen)

-

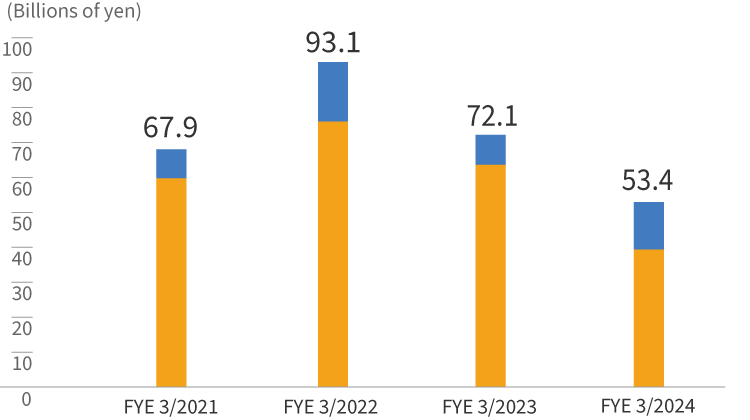

Capital Expenditures

- Food

- Pharmaceuticals

Food

¥40.6billion

Pharmaceuticals

¥15.6billion

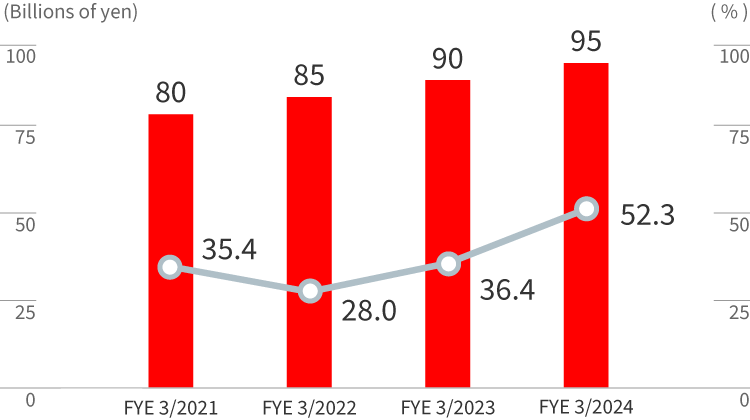

Cash Dividends per Share / Dividend Payout Ratio

- Cash Dividends per Share

Dividend Payout Ratio

Future Prospects

| FYE3/2024 Results |

FYE3/2025 Results |

FYE3/2026 Targets (Revised plan) |

||

|---|---|---|---|---|

| Net sales | ¥1,105.4 billion | ¥1,154.0 billion | ¥1,177.0 billion | |

| Operating income | ¥84.3 billion | ¥84.7 billion | ¥91.0 billion | |

| Operating income ratio | 7.6% | 7.3% | 7.7% | |

| ROE | 6.9% | 6.8% | 7.0% | |

| as of November 13, 2025 |