2026 Medium-term Business Plan

Concept

Evolve the Meiji ROESG®* Management

Return to a growth trajectory by transforming focus markets, business structure, and our behavior

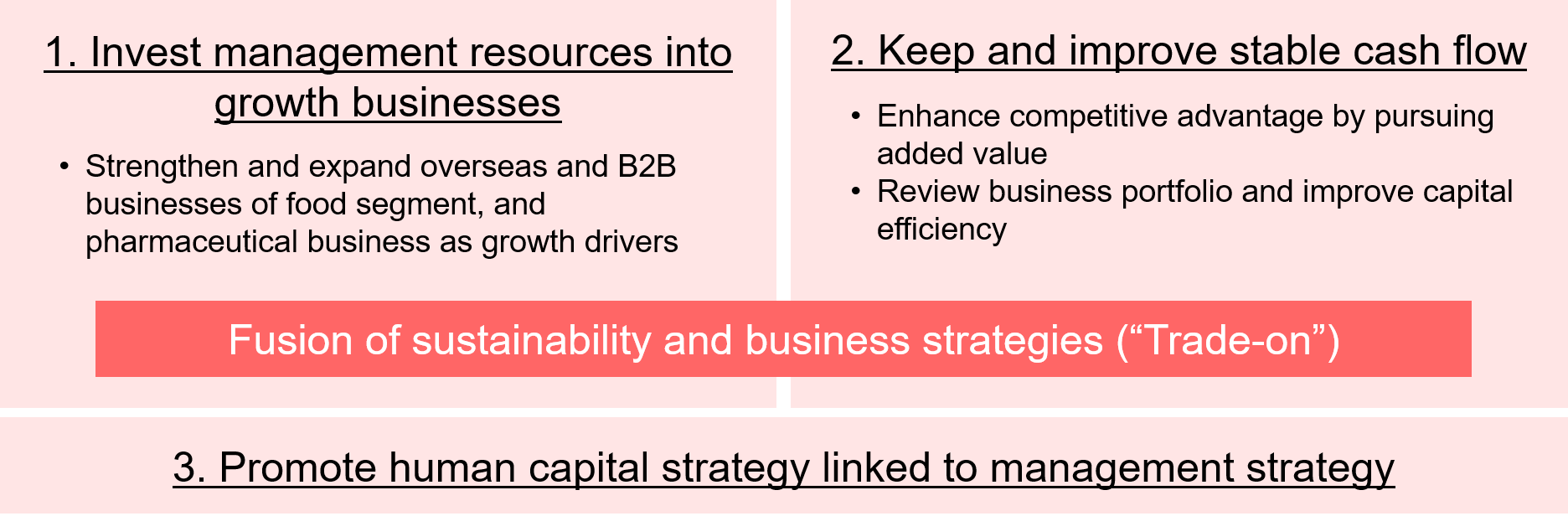

During the 2026 Medium-Term Business Plan, we will aim to return to a growth trajectory by transforming focus markets, business structure, and our behavior as we see to further evolve the Meiji ROESG management we outlined in the 2023 Medium-Term Business Plan. We will incorporate resolving social issues into business strategy and work to create social value through sustainability innovation, and achieve sustainable growth through "trade-on" with economic value.

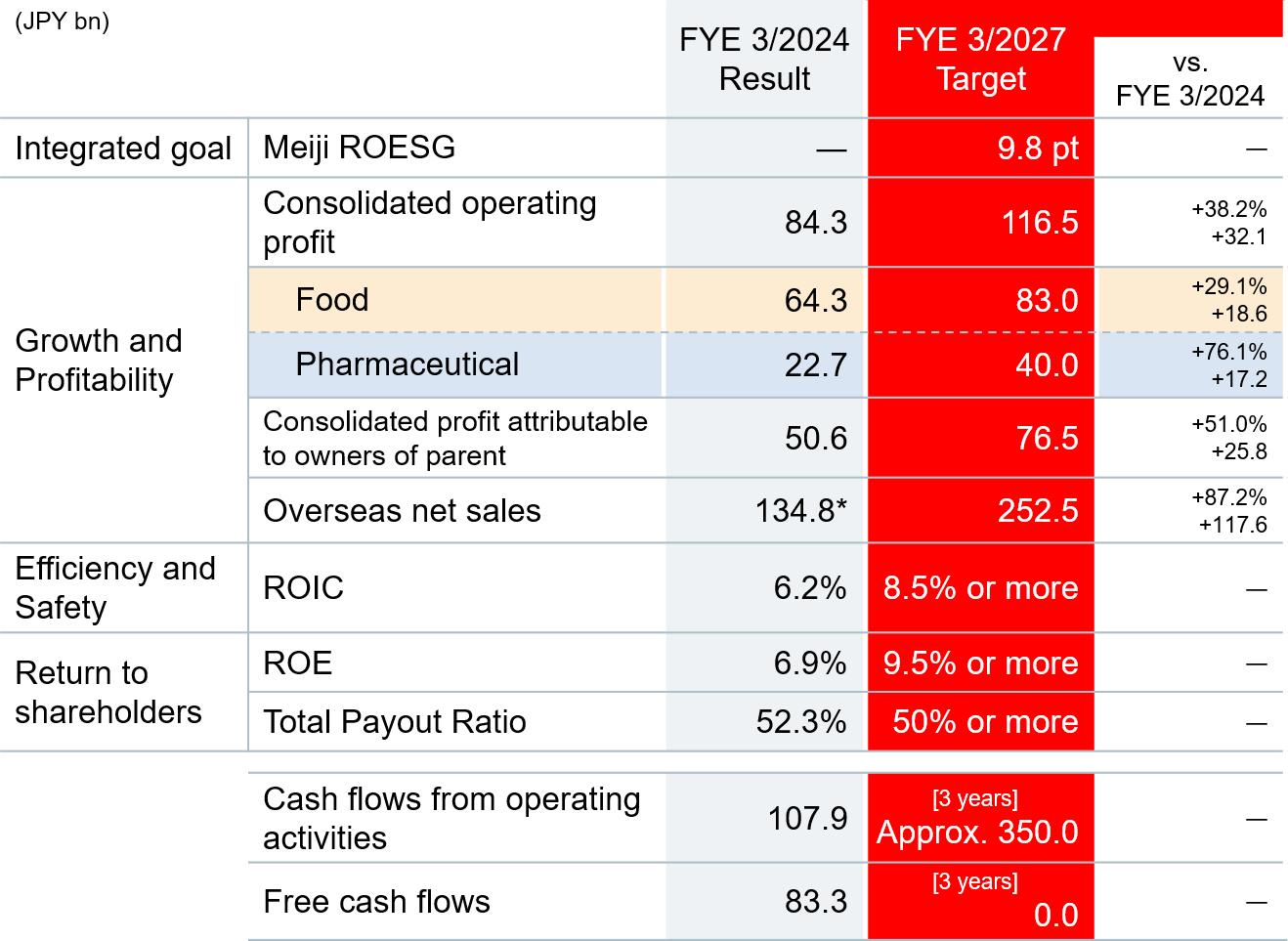

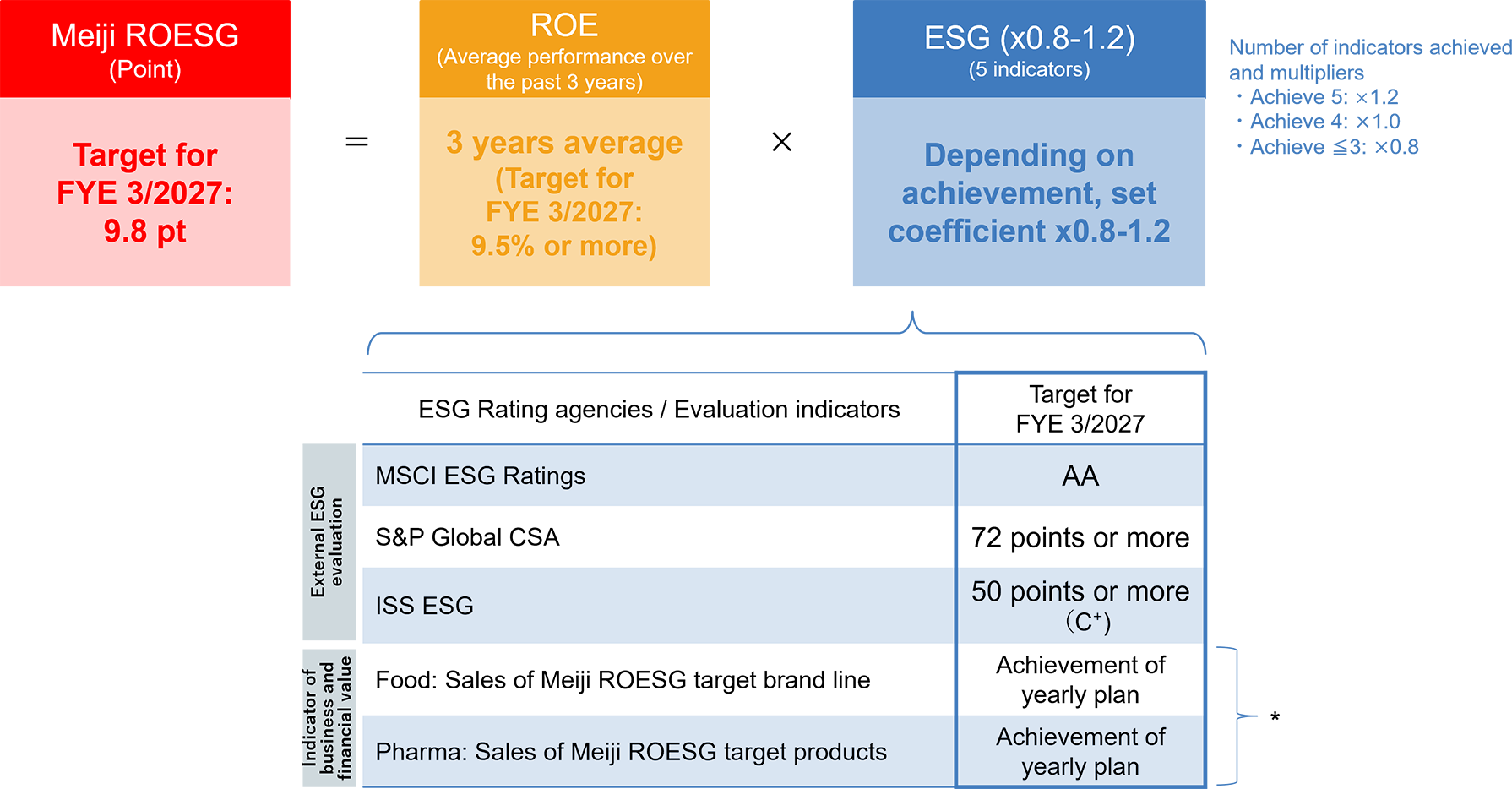

Meiji ROESG

We introduced the Meiji ROESG as the management indicator with the highest priority. The Meiji ROESG consists of two components: ROE, which represents earning power; and the degree of achievement of ESG goals. We aim to grow profits and improve ESG indicators.

CEO MessageKey Strategy

1. Invest management resources into growth businesses

Food Segment

Accelerate to grow overseas business

Strengthen and expand B to B businesses

Pharmaceutical Segment

- Maximize the value of newly launched products

- Accelerate the development of revolutionary new drug pipelines

2. Keep and improve stable cash flow

Food Segment

Develop new "market-creating" products that link sustainability to added value and economic value in existing businesses

Sustainability 2026 VisionMaximize the value of existing products

Launch solution business and service utilizing digital technology, and use it for marketing

Pharmaceutical Segment

- Strive to stably supply pharmaceuticals linked to national strategy

- Solidify domestic generic drugs value chain through collaboration with other companies

Overall group

Use ROIC to strengthen our business management structure

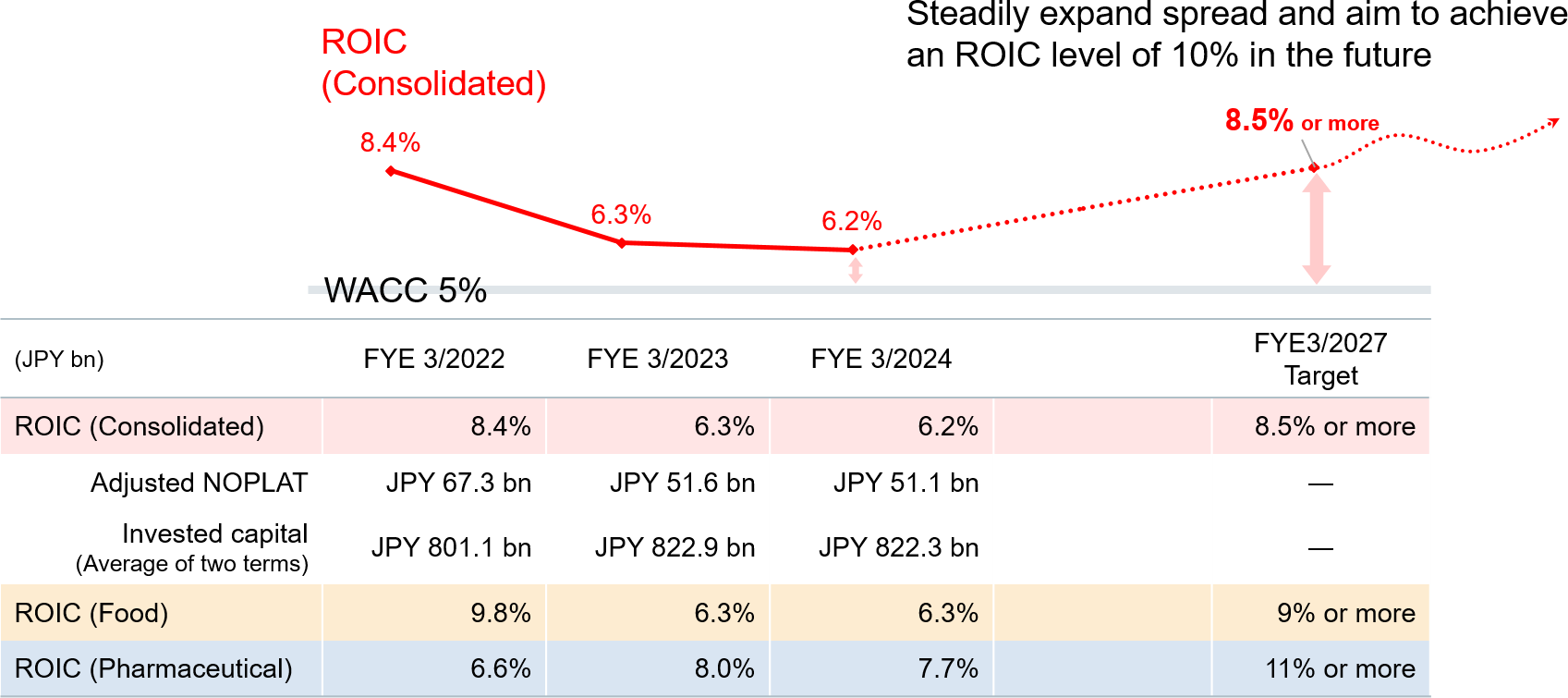

We will improve ROE to achieve the target of the Meiji ROESG, our highest management goal. Therefore, we will work to improve capital efficiency using ROIC. We will continuously improve our operating profit margin led by sales growth and cost reduction, and control invested capital.

We recognize 5% as our WACC, and establish separate hurdle rates for the food and pharmaceutical segments (food: 6%, pharmaceutical: 7%) to strengthen the business-specific ROIC management structure.

We will steadily expand the spread between ROIC and WACC, and aim to achieve an ROIC level of 10% in the future.

3. Promote human capital strategy linked to management strategy

We will focus on the following two points of the human capital strategy to support the growth strategy.

Build human capital portfolio necessary for growth strategies

×

Increase employee engagement and improve the performance of each employee

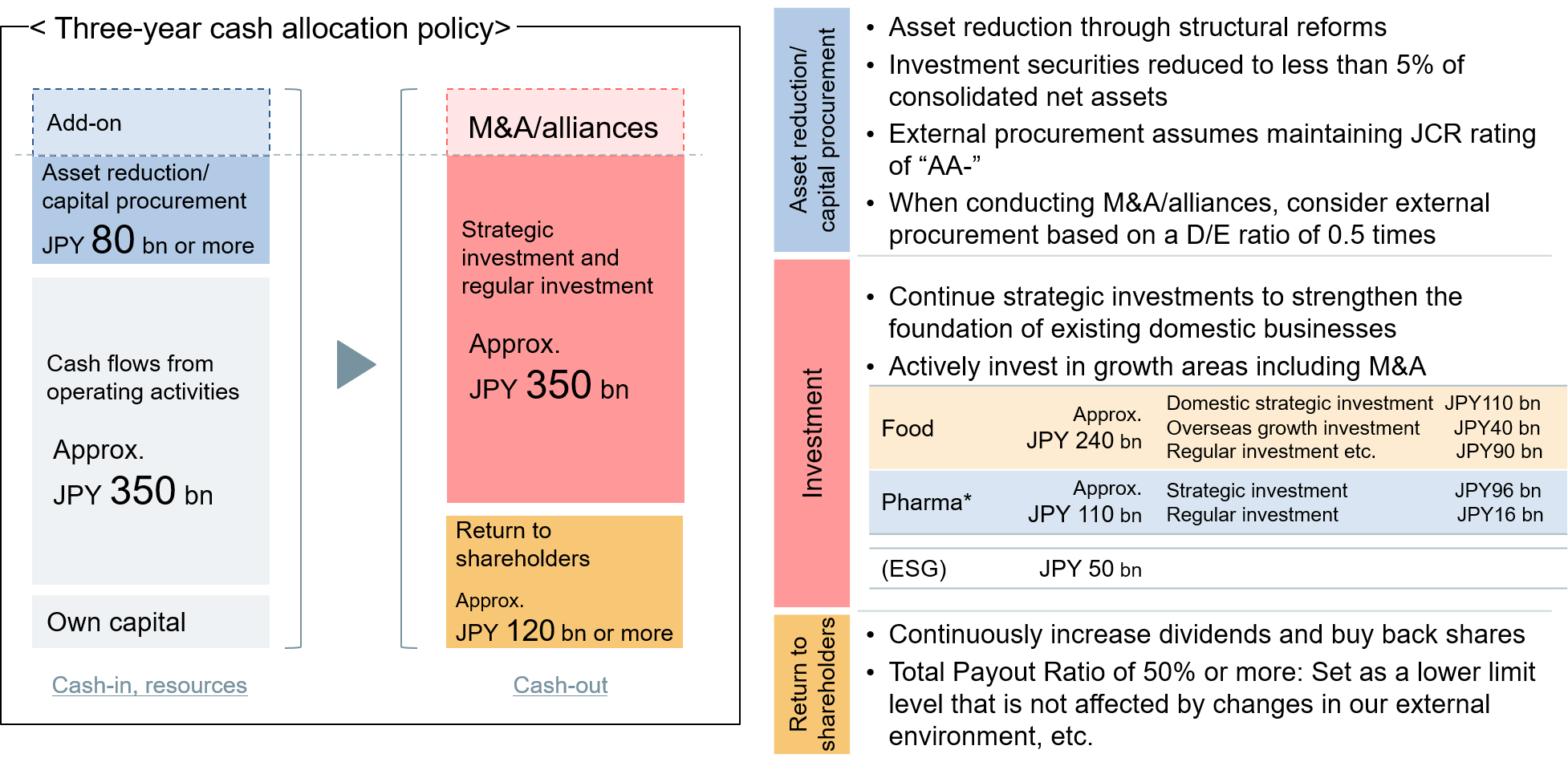

Financial Strategy

* Figures are net of subsidies

KPI

With the following KPIs, we will steadily implement measures to evolve Meiji ROESG management.