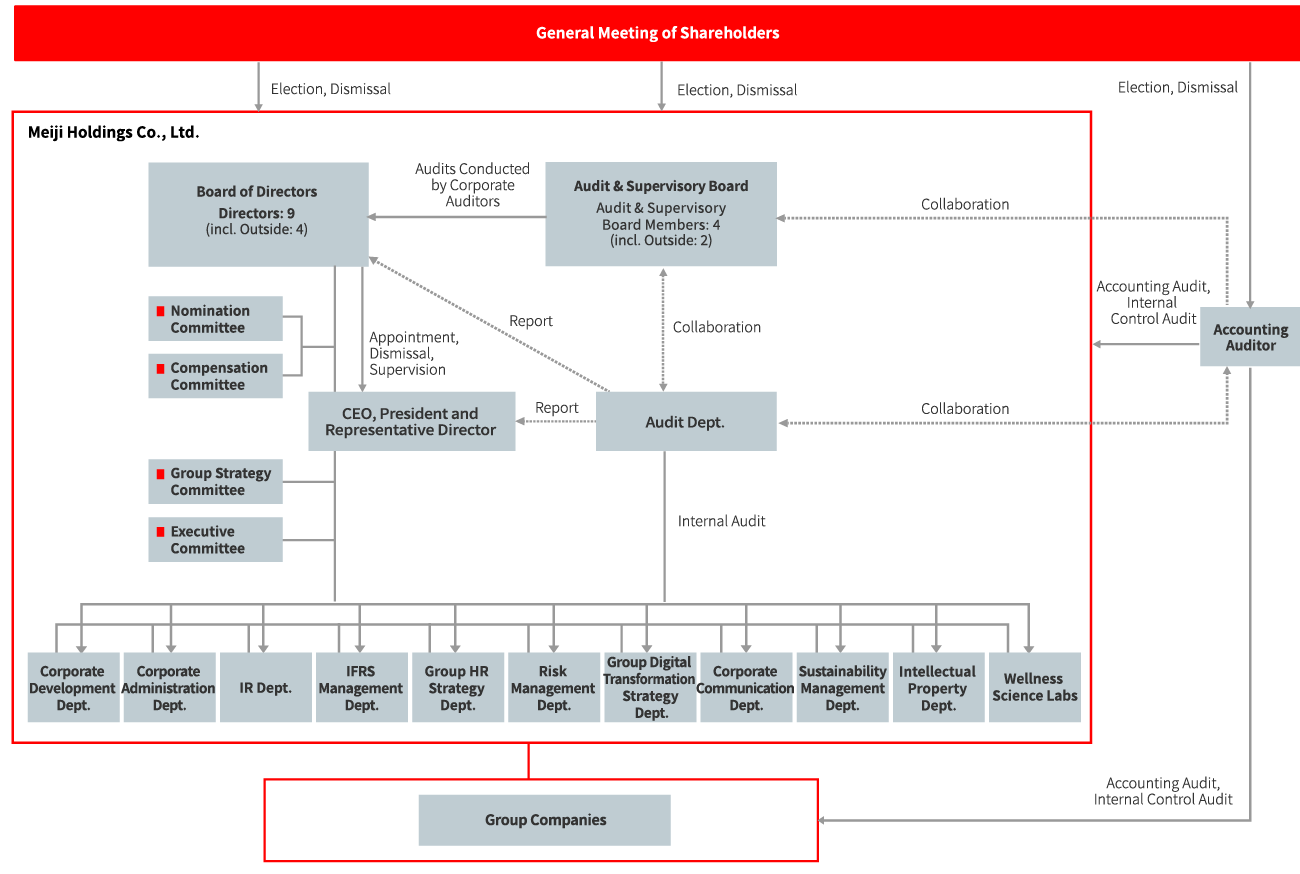

Business Management System

Corporate Governance System

Business Management System Features

- Appointment of four outside directors and two outside audit & supervisory board members, all of whom are designated as independent directors

- Limitation of the term of service for directors to one year

- Introduction of an executive officer system to separate business execution and audit functions and to accelerate management decisions while clarifying management responsibility

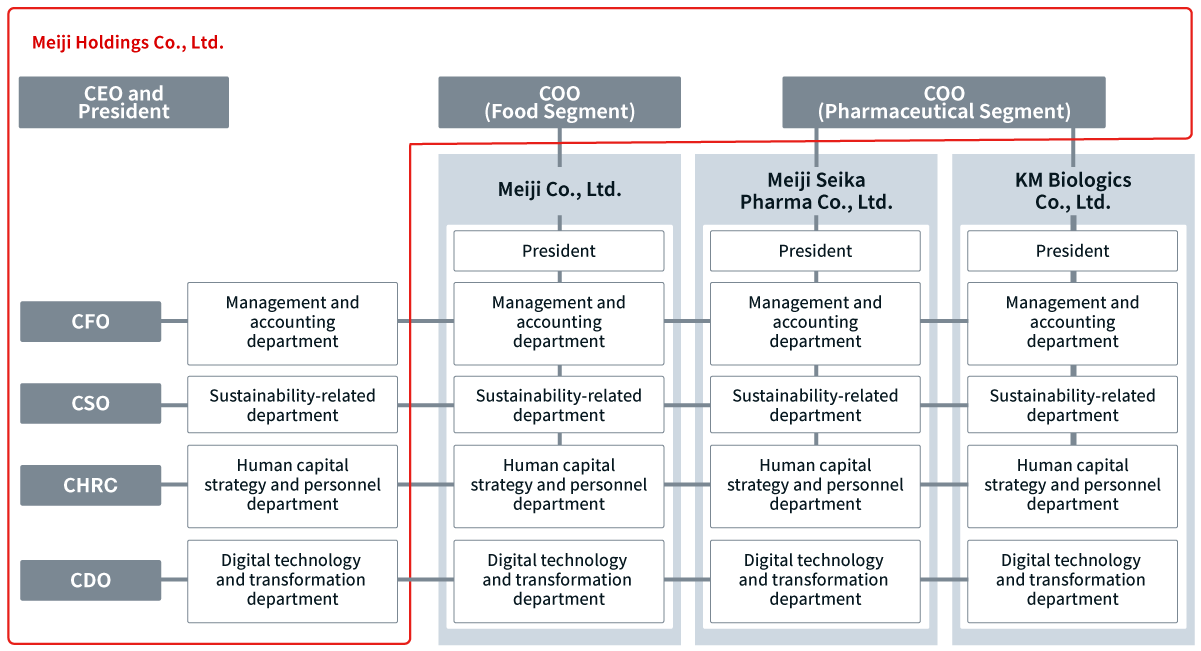

- Introduction of Chief Officer system to strengthen group management. Serving in the highest positions of responsibility within the Meiji Group (the "Group"), Chief Officers work in line with basic management policies outlined by the Board of Directors to supervise and oversee Group business or functions.

Chief Officer Management System

Initiatives to Enhance the Corporate Governance System and Improve its Efficacy

| Group Management Structure |

|

|---|---|

| Institutional Design | |

| Policy | |

| Support System for Directors' Independence |

|

| Nomination | |

| Compensation | |

| Board of Directors Efficacy Evaluation |

|

| Other |

Board of Directors

The role of Meji Holdings Co., Ltd. (the "Company") Board of Directors is to formulate and pursue Group-wide strategies, oversee the management of operating companies, and carefully monitor the effectiveness of managers and directors from an independent and objective perspective, with a view to making the Group Philosophy a reality, contributing to the Group's sustainable growth and corporate value over the medium- to long-term, and improving profitability and capital efficiency.

Structure

- We recognize that diversity is an important element of the Group's management strategy. Therefore, while considering diversity such as their nationality, gender, or age, at least one-third of Board of Directors shall be independent outside directors.

- Director candidates are chosen considering diversity such as their nationality, gender, or age, and are nominated for their advanced knowledge and expertise in fields needed to realize the Meiji Group 2026 Vision. These fields include areas such as business strategy, global business, sales and marketing, finance and accounting, HR and diversity, legal affairs and risk management, corporate communications, sustainability, and digital.

- The Board of Directors should be consist of managing directors to oversee core operations, executives to manage operating companies, and non-executive directors including at least one-third of independent outside directors. Currently the number of Board of Directors would be around 10.

- The Board of Directors currently consists of four independent outside directors (including two female directors and one foreign director) and five internal directors for a total of nine directors.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Inside director | Kazuo Kawamura | 17 of 17 meetings (100%) |

| Inside director | Daikichiro Kobayashi | 17 of 17 meetings (100%) |

| Inside director | Katsunari Matsuda | 17 of 17 meetings (100%) |

| Inside director | Jun Furuta | 17 of 17 meetings (100%) |

| Inside director | Jun Hishinuma | 13 of 13 meetings (100%), since taking office on June 27, 2024 |

| Outside director | Mariko Matsumura | 17 of 17 meetings (100%) |

| Outside director | Masaya Kawata | 17 of 17 meetings (100%) |

| Outside director | Michiko Kuboyama | 17 of 17 meetings (100%) |

| Outside director | Peter David Pedersen | 17 of 17 meetings (100%) |

| Internal audit & supervisory board member | Hiroaki Chida | 17 of 17 meetings (100%) |

| Internal audit & supervisory board member | Takayoshi Ohno | 17 of 17 meetings (100%) |

| Outside audit & supervisory board member | Hajime Watanabe | 17 of 17 meetings (100%) |

| Outside audit & supervisory board member | Makoto Ando | 16 of 17 meetings (94.1%) |

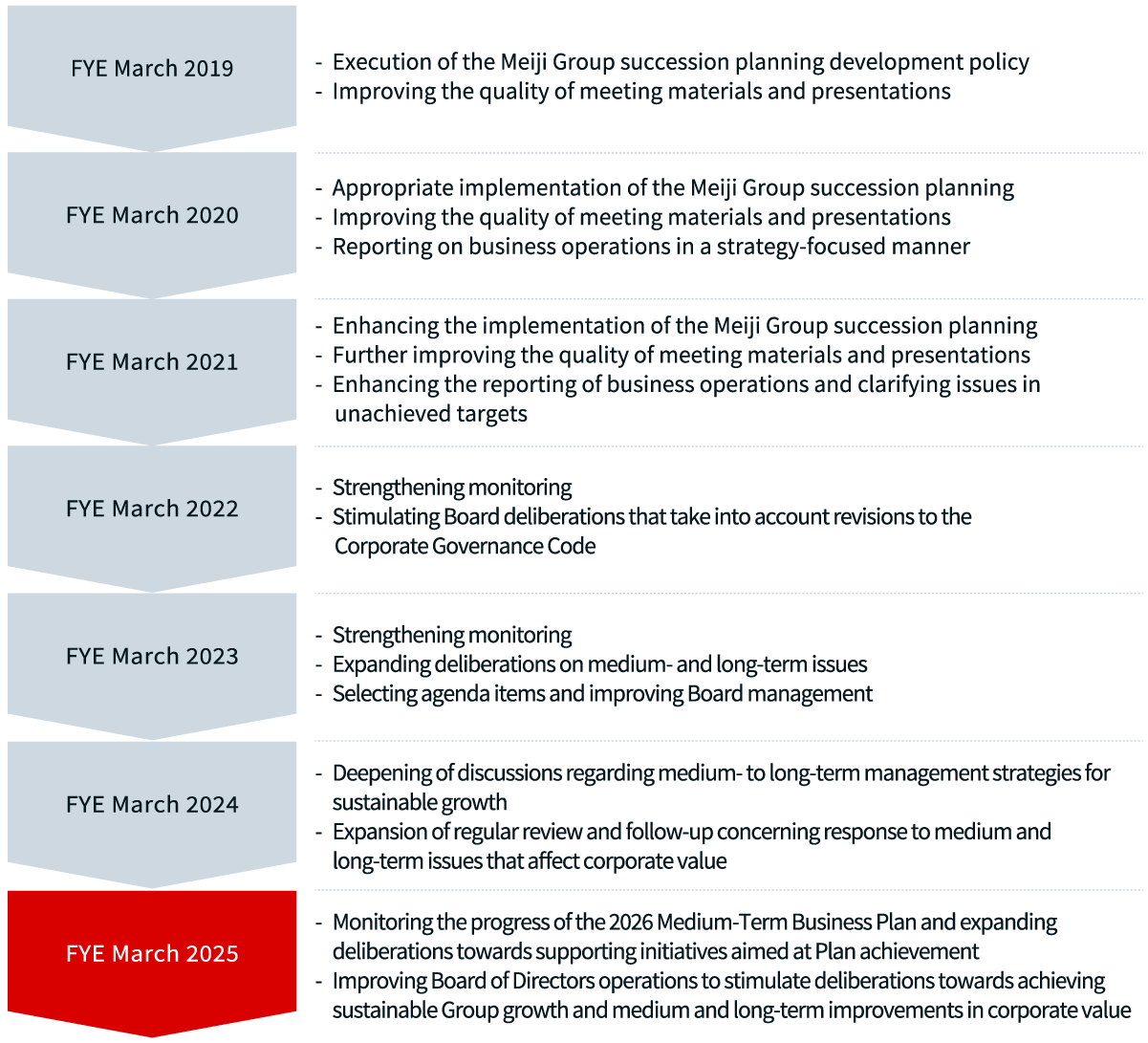

Evaluation of the Board of Directors

Once a year, the Company analyzes and evaluates the effectiveness of the Board of Directors as a whole, taking into consideration the results of surveys on the role and management of the Board of Directors and problems or issues that the Board faces, including a self-evaluation questionnaire submitted by members of the Board of Directors. The Company then takes remedial measures to address any issues highlighted in the surveys. We work to improve the effectiveness of the Board of Directors neutrally and objectively by having third-party assessments conducted approximately once every three years.

1. Method for analyzing/evaluating how effectively the Board functioned in FYE March 2025

In line with our own corporate governance policy, which we established in October 2015, we requested an evaluation by third-party assessment organization to evaluate how effectively the Board of Directors functioned during the FYE March 2025, which we conduct once every three years. Each member of the Board completed a self-assessment, and third-party assessment organization conducted individual interviews based on the results of the questionnaires. The results of evaluations based on those responses were submitted to the Board of Directors as primary evaluation result. The Board of Directors then evaluated and deliberated on those findings, and summarized evaluation results.

Self-Evaluation Questionnaire Topics

- Roles of the Board of Directors

(setting strategic direction, overseeing company, succession planning, discussing/reporting on business matters) - Composition of the Board of Directors

(scale, diversity, composition ratio of internal and external) - Operating status of the Board of Directors

(discussion, chairperson of the Board, secretariat, content and quality of submissions and presentations) - Response to issues from the previous year

- Support system for Outside Directors

2. Results of analyzing/evaluating how effectively the Board functioned in FYE March 2025

According to the evaluation results by third-party assessment organization and the board meetings records, we confirm the Board is operating effectively. We monitored the two issues previously identified: (1) monitoring the progress of the 2026 Medium-Term Business Plan and expanding deliberations towards supporting initiatives aimed at Plan achievement, and (2) improving Board of Directors operations to stimulate deliberations towards achieving sustainable Group growth and medium and long-term improvements in corporate value. We confirmed that progress is being made on these implemented initiatives.

On the other hand, we received recommendations concerning issues that require continued efforts, particularly the need to enhance strategic deliberations, refine the CEO selection process, and formulate a successor plan for outside directors.

3. Initiatives for the FYE March 2026

In FYE March 2025, we will work further to improve the following issues we recognized to enhance the efficacy of the Board of Directors and strengthen corporate governance.

- Monitoring the progress of the 2026 Medium-Term Business Plan and expanding deliberations towards supporting initiatives aimed at Plan achievement

- Improving Board of Directors operations to stimulate deliberations towards achieving sustainable Group growth and medium and long-term improvements in corporate value.

Audit & Supervisory Board

Audit & Supervisory Board work towards sustainable growth and medium- to long-term growth in corporate value as a part in the governance of the Company together with the Board of Directors. Also, Audit & Supervisory Board fulfills the roles and responsibilities from an independent and objective standpoint based on the Company's fiduciary and accountability duties to shareholders.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Internal audit & supervisory board member | Hiroaki Chida | 16 of 16 meetings (100%) |

| Internal audit & supervisory board member | Takayoshi Ohno | 16 of 16 meetings (100%) |

| Outside audit & supervisory board member | Hajime Watanabe | 16 of 16 meetings (100%) |

| Outside audit & supervisory board member | Makoto Ando | 15 of 16 meetings (93.8%) |

Functions and Roles of any Committee or Other Meeting

Nomination Committee

- Composition (FYE March 2025): Outside director 4, inside director 1

- Chairperson: Outside director

Chairperson is selected from among members who are independent outside directors and appointments shall be made so that the chairperson does not also serve as chairperson of both Nomination Committee and Compensation Committee. - Roles and functions: Nomination Committee provides the Board of Directors with proposals for the nomination or removal of directors and Audit & Supervisory Board members, and deliberates and advises on the nomination or removal of executive officers, including the president. The Committee also deliberates and advises on matters such as succession plans.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Inside director | Kazuo Kawamura | 7 of 7 meetings (100%) |

| Outside director | Mariko Matsumura | 7 of 7 meetings (100%) |

| Outside director | Masaya Kawata | 7 of 7 meetings (100%) |

| Outside director | Michiko Kuboyama | 7 of 7 meetings (100%) |

| Outside director | Peter David Pedersen | 7 of 7 meetings (100%) |

Compensation Committee

- Composition (FYE March 2024): Outside director 4, inside director 1

- Chairperson: Outside director

Chairperson is selected from among members who are independent outside directors and appointments shall be made so that the chairperson does not also serve as chairperson of both Nomination Committee and Compensation Committee. - Roles and functions: Compensation Committee deliberates on policies regarding the determination of compensation for directors and executive officers, the amount of compensation, the level of compensation, etc., and reports to the Board of Directors.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Inside director | Kazuo Kawamura | 2 of 2 meetings (100%) |

| Outside director | Mariko Matsumura | 2 of 2 meetings (100%) |

| Outside director | Masaya Kawata | 2 of 2 meetings (100%) |

| Outside director | Michiko Kuboyama | 2 of 2 meetings (100%) |

| Outside director | Peter David Pedersen | 2 of 2 meetings (100%) |

Executive Committee

- Composition: Board members and executive officers

- Roles and functions: Executive Committee serves as an advisory body to the CEO & President and deliberates important matters related to business execution based on the basic strategic policy outlined by the Board of Directors.

The Group Strategy Committee

- Composition:

CEO (Chief Executive Officer)

CFO (Chief Financial Officer)

CSO (Chief Sustainability Officer)

COO (Chief Operating Officer) of the Pharmaceutical Segment

COO (Chief Operating Officer) of the Food Segment

CHRO (Chief Human Resource Officer)

CDO (Chief Digital Officer) - Roles and functions:

The Group Strategy Committee applies basic management policy adopted by the Board of Directors towards determining the direction of core matters such as the Group's overall vision, business plans, business policy, and the allocation of management resources.

In addition to the above, we provide a forum for exchanging opinions between outside directors and outside corporate auditors, which is utilized for the more effective management of the Board of Directors.

Auditing Structure and Audit & Supervisory Board

Internal Auditing Division

We have established an Audit Department (internal audit staff: 7), which reports directly to the CEO, President and Representative Director as an auditing division. This department collaborates with other internal auditing divisions within the Group to conduct internal audits.

Internal auditing divisions hold regular monthly meetings with the Audit & Supervisory Board to share information and exchange opinions on the status of activities. The division works to strengthen cooperation with the accounting auditor by regularly sharing information.

Governance Audits of Overseas Group Companies

For overseas Group companies, generally thought to have higher risks than in Japan, in addition to conventional business audits, we also have established a structure for conducting audits specifically designed to reduce fraud and other management risks (referred to as "governance audits"). Governance audits are generally conducted three to four times a year to confirm frameworks and management related to fraud prevention, including promotion of Meiji Group Code of Conduct, Meiji Group Policy awareness, anti-corruption, the separation of duties, whistleblowing systems, and risk management systems. We use external experts to ensure audit efficiency and efficacy.

Audit results are reported to audited companies and also shared with the Group CEO and other relevant officers, corporate auditors, and each operating company. Through these initiatives, we are working to strengthen our internal systems, and enhance our fraud checks and prevention.

| Independent auditor | Ernst & Young ShinNihon LLC |

|---|---|

| Audit department (internal auditing) | Audit Department |

| Principal meetings auditors attend | Board of Directors, Executive Committee, Audit & Supervisory Board, Audit Department Liaison Meeting, and others |

Internal Control System

We provide products and services to a large number of customers through our food and pharmaceutical business operations. In accordance with the Corporate Behavior Charter, the Meiji Group has established an internal control system befitting the Group and the Group companies that is based on mutual collaboration and multifaceted checking functions to ensure directors, executive officers, and other employees comply with the Food Sanitation Act, the Pharmaceutical and Medical Device Act, and other statutory laws and regulations and the Articles of Incorporation, thereby ensuring fair and sound business activities firmly rooted in compliance.

Cross-shareholding of Listed Companies

The Group does not hold shares that are not recognized as contributing to sustainable growth and improvement of corporate value over the medium- to long-term, taking into consideration the necessity of business operations.

We hold listed shares as cross-shareholdings when we think it would:

- 1) Accelerate the group's financial operations

- 2) Strengthen the relationship with our group companies

- 3) Strengthen the group's transactional relationships

- 4) Be reasonable in light of our responsibility to shareholders

Every year, the Board of Directors reviews all the brands the Group is holding and determines whether the company should continue holding them or dispose of them. We will verify the suitability of possession and disclose the details of the verification. For each brand, the Board considers the following factors:

- The rationale for holding the brand

- The transactions for the brand in the past year

- The medium- to long-term outlook for the brand

- The amount of dividend

As a rule, we will exercise our voting rights in line with the wishes of the stock issuing company's Board of Directors. However, we will decline to do so if we think that it would negatively impact the business relationships with the Group or if it would clearly harm the common interests of shareholders.

When a company holding Meiji shares for strategic purposes (cross-shareholding company) indicates the intention to sell the stock, we do not interfere with the sale of the share.

We do not engage in transactions that would interfere with Group and shareholder common interests, including transactions with cross-shareholding companies without sufficiently validating the economic feasibility of the transaction.

Related Party Transactions

Directors and Audit & Supervisory Board members of the Company or a major operating company may not engage in material transactions with the Company or a major operating company without the approval of the Company's Board of Directors. Where such transactions are approved, the status of said transactions must be reported to the Company's Board of Directors.

Constructive Dialogue with Shareholders

The Company pursues the following measures for promoting constructive dialogue with shareholders.

- The Company positively and voluntarily engages with shareholders so as to promote constructive dialogue with them. General communication with shareholders is managed by the Investor Relations (IR) Department, which is managed by the executive officer in charge of IR. To a practical extent, we also engage in dialogue with directors and Audit & Supervisory Board members, including outside officers.

- With the aim of supporting shareholder dialogue, the director in charge of IR organizes liaison meetings with personnel from other departments, including Corporate Planning, Corporate Administration, and Risk Management, so as to share information between the departments.

- In addition to one-on-one meetings, the Company holds earnings conferences twice-yearly for institutional investors and securities analysts to announce the second quarter and the fiscal year results, as well as small meetings led by the Company President. We also hold earnings conferences with institutional investors and securities analysts at the end of the first and third quarter.

- We work to promote dialogue with individual investors and to inform them about the group's businesses. In FYE March 2025, we held factory tours and online briefings for individual investors.

- We actively promote ESG dialogue with investors. We hold one-on-one meetings with institutional investors and conferences for institutional investors and securities analysts.

- We provide information via our website for shareholders and investors. We publish our investment securities reports (Japanese/English), earnings flash reports (Japanese/English), integrated reports (Japanese/English), and earnings conference materials (Japanese/English) on this website. We also stream video of our earnings conferences (Japanese/English) and publish a Q&A summary (Japanese/English) to further communication.