Sustainable Finance

Meiji Holdings issued sustainability bonds* (10th series of unsecured corporate bonds) through a public offering on Japanese markets in April 2021.

As food and health professionals, we strive to create new value and contribute through our business activities and environmental initiatives to the realization of a future society where all people can lead happy, healthy lives.

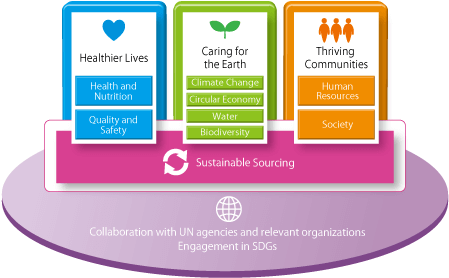

In the Meiji Group 2026 Vision, we position contributions to solving societal problems as one of our core policies. We drafted the Meiji Group Sustainability 2026 Vision to outline specific policies towards achieving this goal, and we are continuing to work towards its realization.

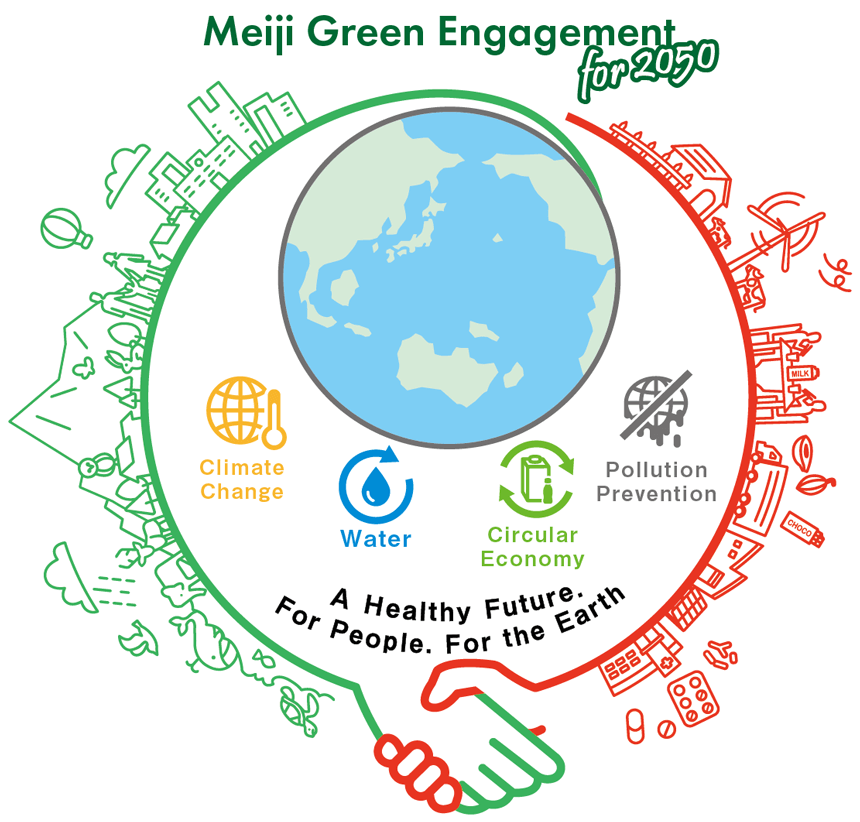

Additionally, we outlined Meiji Green Engagement for 2050, our long-term environmental vision, in March 2021. We will collaborate with various stakeholders in four activity domains: Climate Change, Water Resources, Circular Economy, and Pollution Prevention, and our employees will proactively engage in activities that contribute to realizing a sustainable global environment.

We are actively making use of sustainable finance, based on the sustainability finance framework we set out in January 2021, to secure the capital necessary for realizing these visions of maximizing our contributions to solving societal problems.

Sustainability Bonds Outline

| Name | Meiji Holdings Co., Ltd.'s 10th series of unsecured corporate bonds (Limited inter-bond pari passu rider) (Sustainability Bonds) |

|---|---|

| Maturity: | 5 years |

| Issue amount: | JPY 10.0 billion |

| Coupon rate: | 0.050% |

| Issue date: | Friday, April 23, 2021 |

| Use of proceeds: |

|

| Bond rating | AA- (Japan Credit Rating Agency, Ltd.) |

| Lead managers | Mizuho Securities Co., Ltd., Daiwa Securities Co., Ltd. |

| Structuring agent* | Mizuho Securities Co., Ltd. |

Third-Party Assessment of Framework and Eligibility

For the purposes of issuing sustainability bonds, Meiji Holdings established a sustainable finance framework.* Upon its establishment, it received the highest possible rank (SU1(F)) from the third-party organization, Japan Credit Rating Agency.

Reporting

We annually disclose the fund allocation status reporting and the impact reporting until all raised funds allocated to applicable projects.

Allocation Status Reporting(FY2021)

| Theme | Applicable project | Allocations (JPY 100 million) |

|---|---|---|

| Sustainable Procurement | Procurement of Meiji Sustainable Cocoa Beans | 14.7 |

| Caring for the Earth | Energy efficiency and energy creation at domestic and overseas plants* | 3.6 |

| Securing and conserving domestic and overseas water resources | 7.5 | |

| Switching to environmentally friendly packaging (plastic – paper) | 4.3 | |

| Healthier Lives | Capital investments and R&D for initiatives related to infant nutrition (General infant formulas and special formulas) | 22.9 |

| R&D and capital investments in infectious disease prevention | 4.3 | |

| Total | 57.3 | |

Allocation Status Reporting(FY2022)

| Theme | Applicable project | Allocations (JPY 100 million) |

|---|---|---|

| Sustainable Procurement | Procurement of Meiji Sustainable Cocoa Beans | 14.2 |

| Caring for the Earth | Energy efficiency and energy creation at domestic and overseas plants* | 9.8 |

| Securing and conserving domestic and overseas water resources | 0.7 | |

| Switching to environmentally friendly packaging (plastic – paper) | 4.6 | |

| Healthier Lives | Capital investments and R&D for initiatives related to infant nutrition (General infant formulas and special formulas) | 27.2 |

| R&D and capital investments in infectious disease prevention | 0.3 | |

| Total | 56.8 | |

Impact Reporting(FY2021 - FY2024)

| Applicable Project | Impact Reporting | ||||||

|---|---|---|---|---|---|---|---|

| Output (Project Progress and Results) |

Outcome (Effects Related to Issue Resolutions) |

Impact (Effects Arising From Outcome) |

|||||

| FY2021 | FY2022 | FY2023 | FY2024 | ||||

| Procurement of Meiji Sustainable Cocoa Beans | Procurement of cocoa beans with sustainable programs | Procurement of Meiji Sustainable Cocoa Beans as a percentage of total cocoa beans procured | 42% | 62% | 62% | 100% |

|

| Energy efficiency and energy creation at domestic and overseas plants | Reduce CO2 emissions by at least 50% compared with FY2019 by FY2030 | Reduce CO2 emissions through energy conservation measures at new and existing plants | 1,329t-CO2 | 3,709t-CO2 (The total from FY2021 to FY2022) |

7,625t-CO2 (The total from FY2021 to FY2023) |

11,011t-CO2 (The total from FY2021 to FY2024) |

Reduce CO2 emissions |

| Expand use of electricity derived from renewable energy sources to at least 50% by FY2030 | Reduce CO2 emissions through solar power generation | 1,669t-CO2 | 2,358t-CO2 (The total from FY2021 to FY2022) |

3,014t-CO2 (The total from FY2021 to FY2023) |

3,679t-CO2 (The total from FY2021 to FY2024) |

||

| Eliminate use of specified fluorocarbons at domestic production sites by FY2030. | Number of facilities switched to natural refrigerants or fluorocarbons alternatives | 446 units | 565 units (The total from FY2021 to FY2022) |

717 units*1 (The total from FY2021 to FY2023) |

810 units*1 (The total from FY2021 to FY2024) |

Protect the ozone layer | |

| Securing and conserving domestic and overseas water resources | Upgrade equipment at existing plants and office | Reduction rate of water consumption (basic unit) |

8.4% (compared with FY2017) |

13.3% (FY2022 results) |

15.7% (FY2023 results) |

27.1% (FY2024 results) |

Reduce environmental impact through efficient use of water and appropriate wastewater management, etc. |

| Introduce water-saving equipment at new plants, etc. | |||||||

| Reduce water consumption by at least 15% compared with FY2020 by FY2030 in global |

|||||||

| Switching to environmentally friendly packaging (plastic – paper) | Reduce plastic used for one-way plastic containers and packaging by at least 30% compared with FY2017 by FY2030 | Plastic reduction | 13% (FY2020 results) |

16% (FY2021 results) |

18.3% (FY2022 results) |

22.1% (FY2023 results) |

Solve the issues of marine pollution caused by plastic waste |

| Capital investments and R&D for initiatives related to infant nutrition (General infant formulas and special formulas) | Develop and produce cube-type infant formula | Investment in production facilities for cube-type infant formula |

|

||||

|

JPY 1.3 billion | JPY 2.36 billion | JPY 0.85 billion*1 | -*2 | |||

|

JPY 0.99 billion | JPY 0.36 billion | JPY 0.26 billion*1 | -*2 | |||

| R&D and capital investments in infectious disease prevention | Product development | Status of projects in development | PhaseⅠtrials underway (overseas) | PhaseⅡclinical trial in preparation | PhaseⅡclinical trial in preparation | PhaseⅡclinical trial in preparation |

|

We obtained a review from the Japan Credit Rating Agency to assess the conformity of this reporting with our sustainability finance framework.

Review by the Japan Credit Rating Agency (Issuance date: July 15, 2022)

Review by the Japan Credit Rating Agency (Issuance date: July 14, 2023)

Review by the Japan Credit Rating Agency (Issuance date: July 31, 2024)

Review by the Japan Credit Rating Agency (Issuance date: July 31, 2025)