The Meiji Group Long-Term Environmental Vision

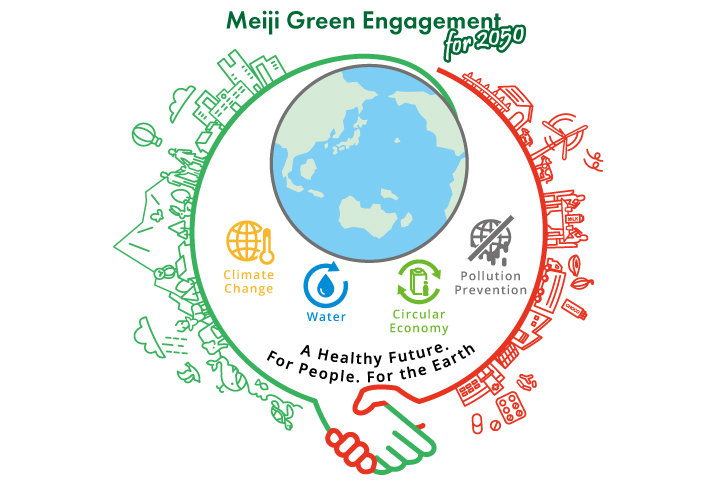

The Meiji Group Long-Term Environmental Vision "Meiji Green Engagement for 2050"

A Healthy Future. For People. For the Earth

The Meiji Group relies on the bounty of nature, including raw milk, cocoa, lactobacillus and microorganisms. We believe it is our duty to live in harmony with the environment and coexist with nature. However, issues such as climate change threaten the sustainability of global environment. The biodiversity provides us the bounty of nature we enjoy, now it is in a crisis. To respond to such crisis we formulated a long-term environmental vision. We are committed to achieving coexistence with nature by engaging in global environmental issues.

The Meiji Group places the importance on delivering health through food and pharmaceutical, creating even more smiles for all. We continue creating value that goes one step further to realize a healthy future for people and the Earth.

Climate Change

Society has become more concerned about the impact of global warming on the intensity of natural disasters and damage to biodiversity. Businesses are being asked to reduce greenhouse gas emissions to help build a decarbonized society. The Paris Agreement, an international framework for addressing climate change, requires efforts to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial revolution levels.

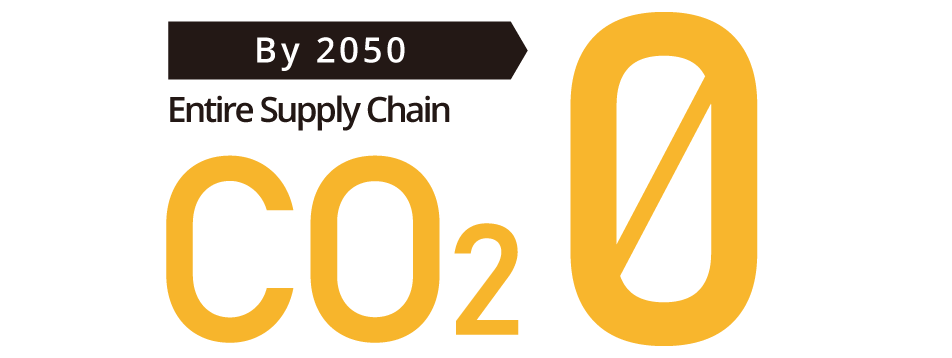

The Meiji Group aims to further mitigate its impact on the global environment, considering the aspirational target of the Paris Agreement to keep the temperature increase below 1.5 degrees Celsius. Accordingly, we have set a goal to become carbon neutral by 2050, eliminating all greenhouse gas emissions throughout our entire supply chain.

Our goals

Eliminate all CO2 and other greenhouse gas emissions throughout our entire supply chain by 2050 (carbon neutral)

Use 100% renewable energy in facilities by 2050

CARBON NEUTRALITY BY 2050

Water

The world's population is estimated to reach 9.7 billion by 2050.1 Consequently, the demand for water is likely to increase by some 55%2 to keep up with the demand due to increase in food production and economic activities as a result of population growth. A total of more than 40%2 of the global population may lose adequate access to enough water due to climate change and the resulting chronic water shortages.

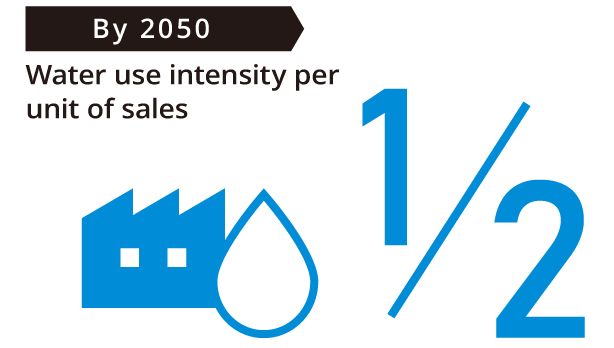

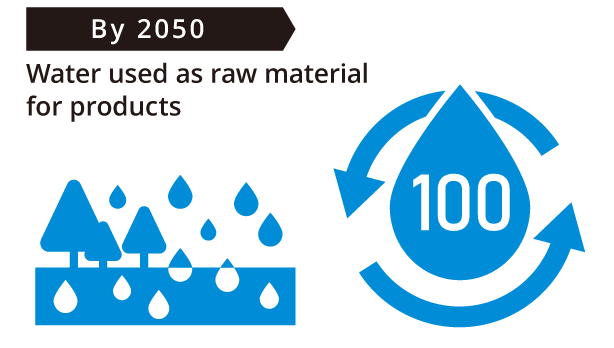

Water is a finite resource. To ensure the sustainability of this limited resource, the Meiji Group aims to become water-neutral. To accomplish this goal, we will engage in initiatives that include reducing water use intensity per sales unit by half and cultivating water resources.

Our goals

Reduce water use intensity per unit of sales by 50% by 2050 compared with FYE March 2021

Restore 100% of the water used as raw material for products by 2050 (water-neutral)

Address to reduce water risks in and around facilities and where we procure raw materials

Circular Economy

Although the natural capital of the earth is finite, we have wasted and discarded them for a long period. These negative activities have led to climate change, deforestation, marine plastic pollution, and numerous other environmental issues. The world must improve the sustainability of natural capital. Because the Meiji Group enjoys the bounty of nature and uses natural capital in products and packaging, we must transition to a circular economy.

To achieve this goal, we should minimize the usage of natural capital by recycling and reusing resources, not to mention achieving zero waste. We will take on the challenge of reducing our environmental impact as close to zero as possible all the way through product design to disposal.

Our goals

Achieve zero waste in the manufacturing process

Use recycled materials in containers and packaging to minimize the use of natural capital

Pollution Prevention

As a result of prioritizing economic growth over the global environment, modern society suffers from air, water, and chemical pollution. As we are breathing polluted air and consuming contaminated food in our daily lives, the health risks are increasing.

The Meiji Group delivers health to the people in the world, and we believe we can build a world that doesn't suffer from pollution. Thus, we are committed to achieve zero pollution throughout the Meiji Group supply chain.

Our goals

Strive to achieve zero pollution due to chemical substances originating from our business activities

Strive to resolve environmental pollution-related issues throughout our supply chain

Environmental Management

Environmental Policy

The Meiji Group established the Meiji Group Environmental Policy. We recognize that our business operations originate from the bounty of nature, will contribute to the creation of a sustainable society.

Environmental Management System

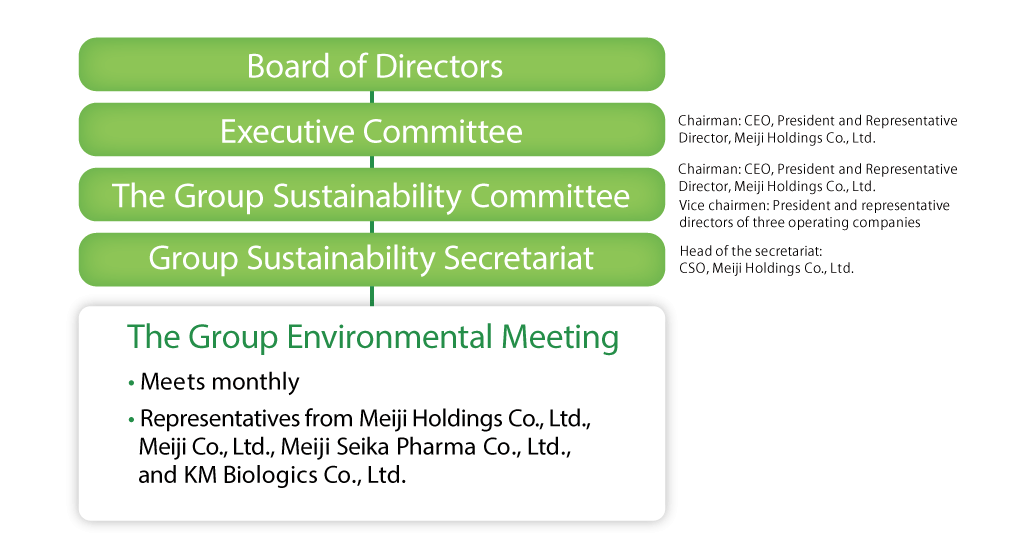

There is The Group Environmental Meeting, which is made up of representatives from our Food segment and Pharmaceutical segment as well as the sustainability representatives from Meiji Holdings. Under this system, the Meeting sets a long-term vision, plans specific measures as well as carries out risk management, and essentially oversees the environmental management for the whole Group.

Past Environment-Related Deliberation Topics at the Group Sustainability Committee

- Progress toward CO reduction targets

- Identifying the state of water risks in Japan and overseas, and exploring prioritization of areas to be addressed

- Checking progress toward achieving water consumption reduction targets

Environmental Data Management System

In October 2019, Meiji Group introduced a cloud-based environmental data management system to identify the integrated environmental impact in overall operating sites of the domestic Meiji Group and accurately and quickly track our performance against targets. Using this system we can reduce input errors and thus collect and calculate data efficiently. Accordingly, we have introduced the system in our overseas operating bases from October 2020.

Certification Status of ISO14001

(As of April 1,2024)

The Meiji Group is promoting attainment of the ISO14001 environmental management certificate for its production sites. We have attained for multi-site certification across all production sites in Japan at FY 2021.

List of Certification Status of ISO14001

Response to environmental laws and accidents

At the Meiji Group, there were no violations, fines related to environmental laws and regulations during FY2023.

| FYE 3/2020 | FYE 3/2021 | FYE 3/2022 | FYE 3/2023 | FYE 3/2024 | |

|---|---|---|---|---|---|

| Number of environmental regulation violations | 0 | 0 | 0 | 0 | 0 |

| Number of major environmental accidents | 2 | 2 | 1 | 0 | 1 |

Approach to climate change and TCFD initiatives

The business of Meiji Group is based on the abundant gifts of nature, so natural capital is an important management resource for us. We also recognize that climate change has a significant long-term impact (risks and opportunities) on our business activities and that it is an important management issue for the Group. At the same time, international frameworks such as the Paris Agreement and the Sustainable Development Goals (SDGs) are calling for increased efforts to address climate change. We are therefore implementing climate change initiatives to contribute to these international efforts by helping to realize a decarbonized society in line with our Meiji Group Sustainability 2026 Vision.

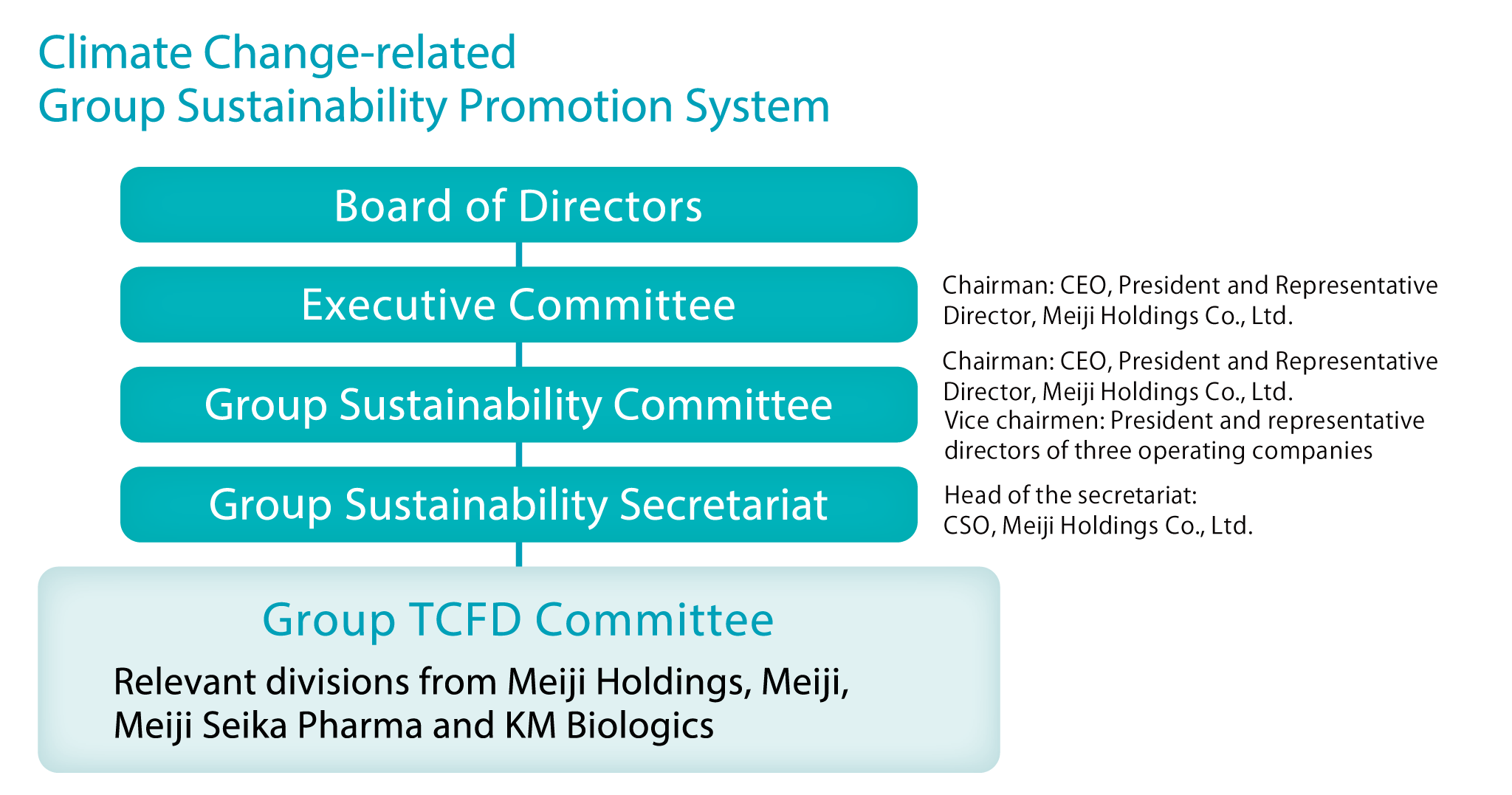

The Meiji Group agreed to join the Task Force on Climate-Related Financial Disclosures (TCFD), which was established by the Financial Stability Board* in 2019. We also joined the TCFD Consortium, which was established by the Ministry of Economy, Trade and Industry, the Ministry of the Environment, and the Financial Services Agency as a place for collaboration among supporting companies, financial institutions and others. We also established the Group TCFD Committee, which comprises relevant divisions from Meiji Holdings and its Group companies Meiji Co., Ltd. , Meiji Seika Pharma and KM Biologics, and started implementing TCFD initiatives from 2019. The purpose of this committee is to reflect climate change-related long-term risks and opportunities in our business activities, as a member of the TCFD scenario analysis project organized by the Ministry of the Environment.

The Group TCFD Committee analyzes climate change related risks and opportunities, develop countermeasures, and manage progress of each initiative.

The Board of Directors, the Executive Committee, and the Group Sustainability Committee discuss the results of these analyses and we strengthened our systems for reflecting the results in our business activities.

In FY2021 the newly established Risk Management Department took part in the Group TCFD Committee. Their efforts strengthened Meiji Group's governance, as well as our institutional ability to respond to important climate change related risks and opportunities.

With regard to scenario analysis, in FY 2020 we performed analysis of the following key areas: dairy ingredients, cocoa, antibiotic drugs (5 Domestic Key Drugs), and vaccines. At the same time, we expanded the scope of analysis to include the entire Meiji Group, further improving our resilience to climate change.

In FY2021, the Risk Management Department took part in the Group TCFD Committee. Their efforts strengthened Meiji Group's governance by helping to establish institutions to respond to important climate change related risks and opportunities.

In addition to the 2°C and 4°C scenarios, in FY2021 we conducted a new 1.5°C scenario analysis, strengthened our analysis of impact for major raw materials, and deeply probed opportunities to further enhance our resilience to climate change. In FY2022, we have begun specific initiatives based on the analysis conducted in FY2021 and disclosed some of them. In FY2023, we recalculated the financial impact for the 1.5 degree and 4degree scenarios. In particular, the flood risk for a 4degree scenario was calculated with reference to the guidelines set out by the Ministry of Land, Infrastructure, Transport and Tourism. Regarding countermeasures, we have updated the progress made on the content disclosed in FY2022, and also disclosed new initiatives.

Climate Change-related Group Sustainability Promotion System

- FY2023 The Meiji Group TCFD Initiative

- FY2022 The Meiji Group TCFD Initiative

- FY2021 The Meiji Group TCFD Initiative

- FY2020 The Meiji Group TCFD Initiative

- Aug–Oct 2019: Practical guide for Scenario Analysis in line with the TCFD recommendations, a Ministry of the Environment support program for companies to analyze their own climate risks and opportunities in line with the TCFD recommendations (PDF 27MB)

- Water Risk Survey Results

Adopted an Internal Carbon Pricing System

The Meiji Group has adopted internal carbon pricing (ICP) system for the Meiji Group's capital investments in energy-saving equipment and other equipment that contribute to reducing CO2 emissions. We have set our internal carbon price at (15,000 yen/t-CO2).

An internal carbon price will be applied to estimate the cost of CO2 emissions. We will use the calculated costs as one of the decision criteria for capital investment plans that entail an increase/decrease in CO2 emissions. By adopting this system, we can now measure financial impact and reduce CO2 emissions.

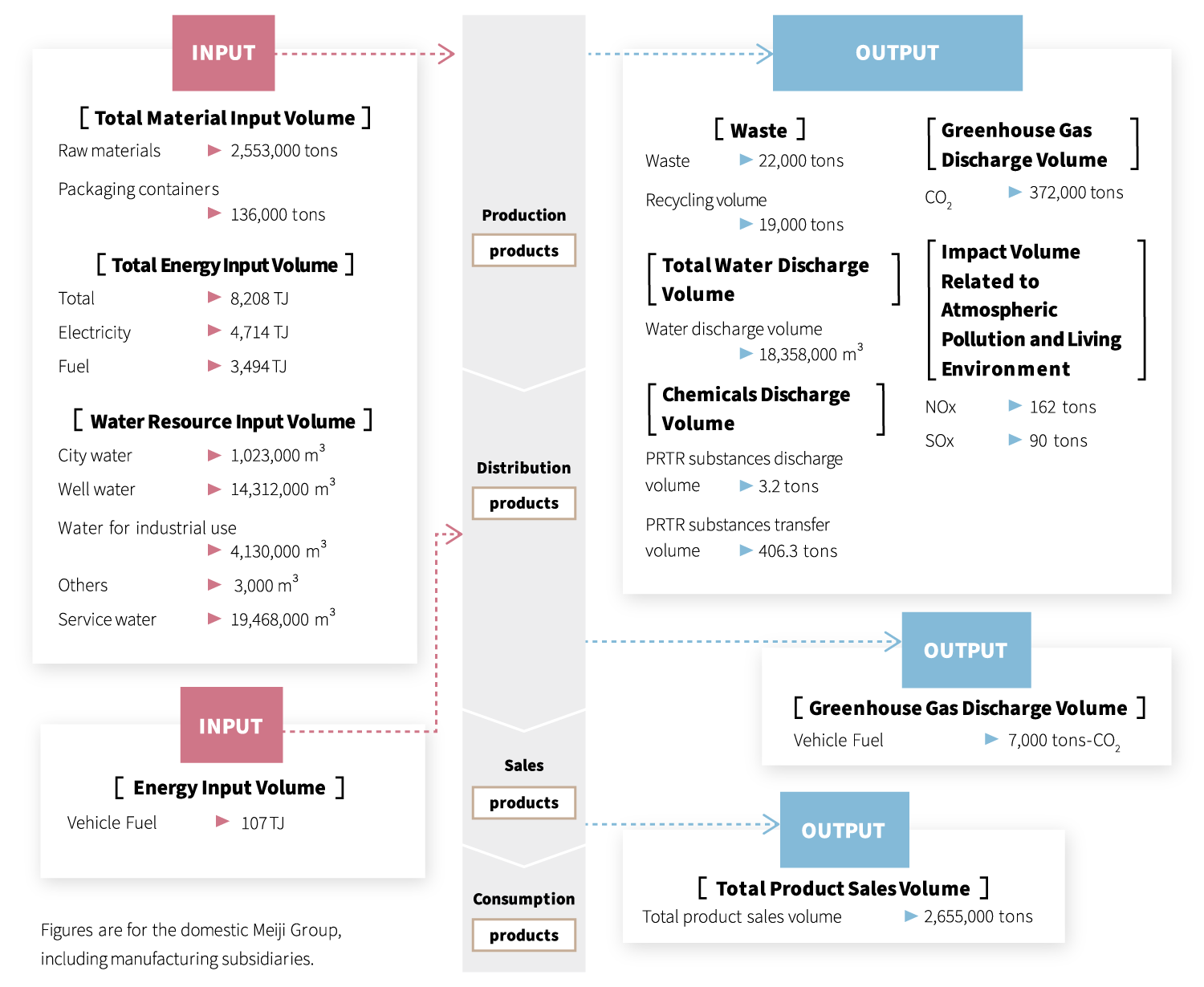

Material Balance (FYE 3/2024)

| Priorities(Environment) | Details of Investment |

|---|---|

| Reduction of CO2 emissions | 1. Installation of or updating to highly-efficient energy-saving equipment 2. Installation of solar panels, etc. |

| Measures against CFC | 1. Installation of or updating to CFC-free refrigerators and freezers, etc. |

| Reduction of Plastic Usage | 1. Reduction in weight of packaging, introduction of equipment enabling reuse 2. Introduction of environmentally conscious packaging equipment |

| Securing Water Resources | 1. Introduction of equipment to reuse the water used for washing in production process 2. Improvement of water quality, introduction of equipment for making use of rain water, etc. |